Market Review: November 21, 2024

Mixed Signals as Jobless Claims Rise, Housing Rebounds, and Manufacturing Contracts Drops

Data from November 21, 2024, reflects a mixed economic picture. Labor market conditions remain stable in initial filings but show softening in continuing claims. The Philadelphia Fed Manufacturing Index fell into contraction territory, highlighting regional manufacturing weakness, while existing home sales exceeded expectations, signaling recovery in the housing market. The U.S. Leading Index declined more than anticipated, pointing to potential future economic challenges. Meanwhile, the 10-Year TIPS auction yield rose sharply, reinforcing demand for inflation-protected securities, and the Federal Reserve’s balance sheet continued its gradual reduction, reflecting ongoing quantitative tightening (QT).

Today's Event Overview:

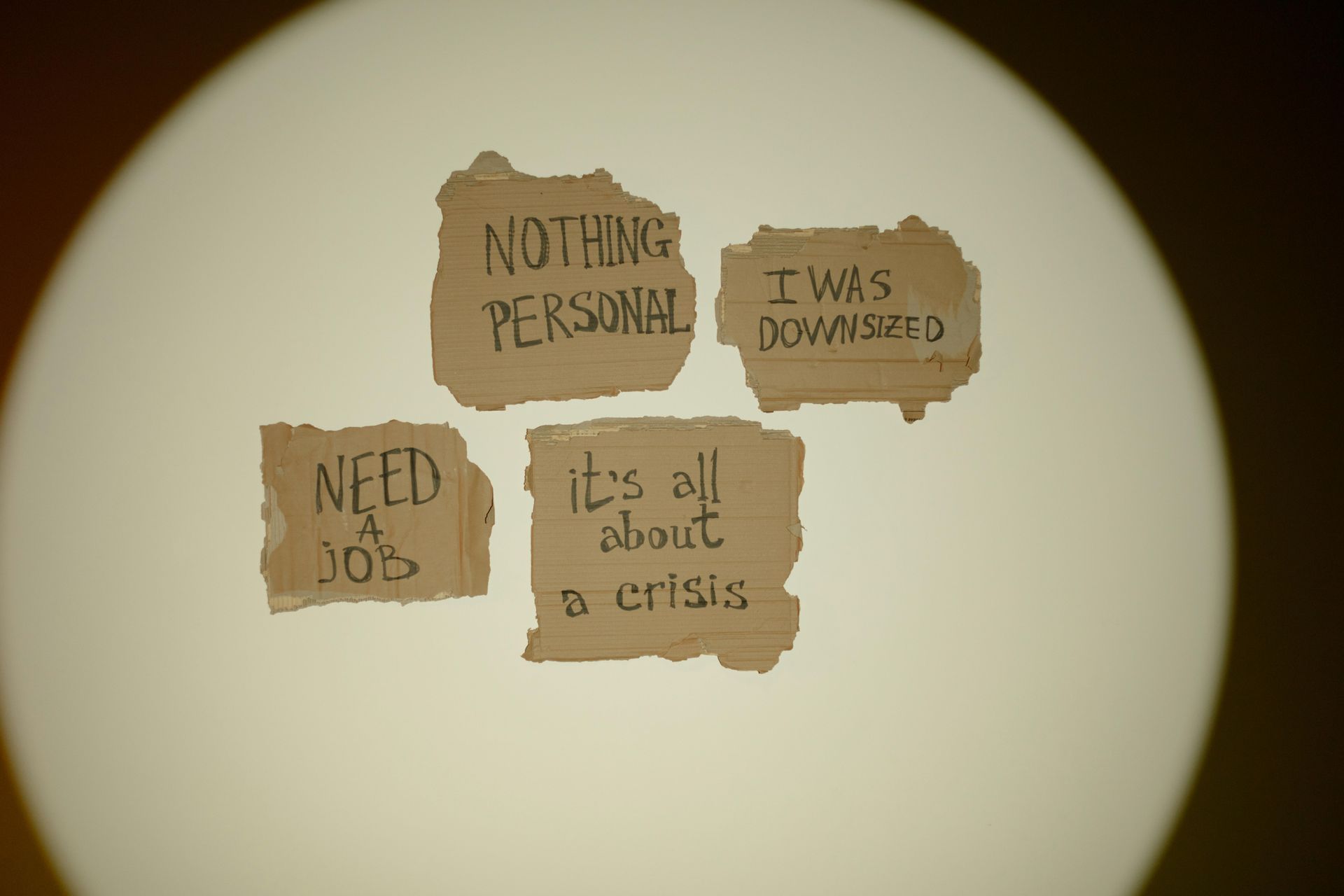

- Continuing and Initial Jobless Claims: Continuing claims rose to 1,908K, indicating potential labor market softening, while initial claims dropped to 213K, reflecting stability in new filings. This divergence suggests resilience in current layoffs but challenges in rehiring.

- Philadelphia Fed Manufacturing Index and Employment: The manufacturing index dropped to -5.5, well below expectations, signaling contraction in regional activity. However, employment within the sector rebounded to 8.6, showing improvement in hiring.

- Existing Home Sales (Oct): Sales increased to 3.96M, slightly above forecast, and rose 3.40% month-over-month, recovering from the prior decline. This rebound reflects stabilization and resilience in the housing market.

- US Leading Index (Oct): The index fell by -0.40%, worse than expected, indicating weaker forward-looking momentum in economic activity.

- 10-Year TIPS Auction: The yield increased to 2.07%, signaling strong demand for inflation-protected securities and rising real rates.

- Fed’s Balance Sheet: The balance sheet decreased to $6,924B, reflecting the continuation of QT and a reduction in market liquidity.

Impact Analysis:

- USD Impact:

The higher yields in the 10-Year TIPS auction and the Fed’s balance sheet reduction provide support for USD strength. However, the rise in continuing jobless claims and the contraction in manufacturing temper the bullish sentiment, leaving the overall impact neutral to slightly bullish for USD. - Gold Impact:

Gold faces bearish pressure from rising TIPS yields and continued QT, which reduce the appeal of non-yielding assets. However, weak manufacturing and leading indicators provide some support as investors hedge against economic uncertainty. The overall sentiment for gold is bearish, leaning toward neutral in light of mixed economic signals. - Equities Futures Impact:

Equities futures are likely to react negatively to signs of manufacturing contraction and the declining leading index, which point to potential growth challenges. However, the rebound in housing sales and stable initial jobless claims provide some optimism, particularly for consumer-driven and real estate sectors. Rising TIPS yields and QT may weigh on growth-sensitive stocks. The overall equities impact is mixed to slightly bearish, with sector-specific variations.

Today’s data underscores an economy grappling with divergent trends. The labor market shows resilience in initial filings but struggles in rehiring, while manufacturing faces significant headwinds. The rebound in housing sales provides a bright spot, but the leading index’s decline suggests caution for future growth. The USD benefits from strong TIPS demand and ongoing QT, while gold and equities face pressure from rising yields and mixed economic signals.

The opinions expressed are those of the authors and are not meant as investment advice or to predict or project the future performance of any investment product. The opinions are current to the publication date, are subject to change at any time based on market and other current conditions, and no forecasts can be guaranteed. This commentary is being provided as a general source of information and is not intended as a recommendation to purchase, sell, or hold any specific security or to engage in any investment strategy. Investment decisions should always be made based on an investor's specific objectives, financial needs, risk tolerance and time horizon.